Auto Loans – Is Bad Credit Stopping Somebody?

Although you will get an auto finance after filing bankruptcy, it ‘s better to wait till your bankruptcy is across. Once you have a discharged bankruptcy, you can expect reduction in interest yields. This is so because lenders associate high risk with filing bankruptcy. But, once you get out of it, chance factor cuts down on. Also, coming out of Sea-Doo Financing is often a major accomplishment. Lenders think that if you can successfully handle a bankruptcy, car loans would be very easy for you. Keeping this in mind, it’s wise to apply after discharging your bankruptcy.

Lenders in order to have just an excellent credit rating. They won’t even touch the application if won’t matter mention a pristine credit score. They will not trust a person sale.

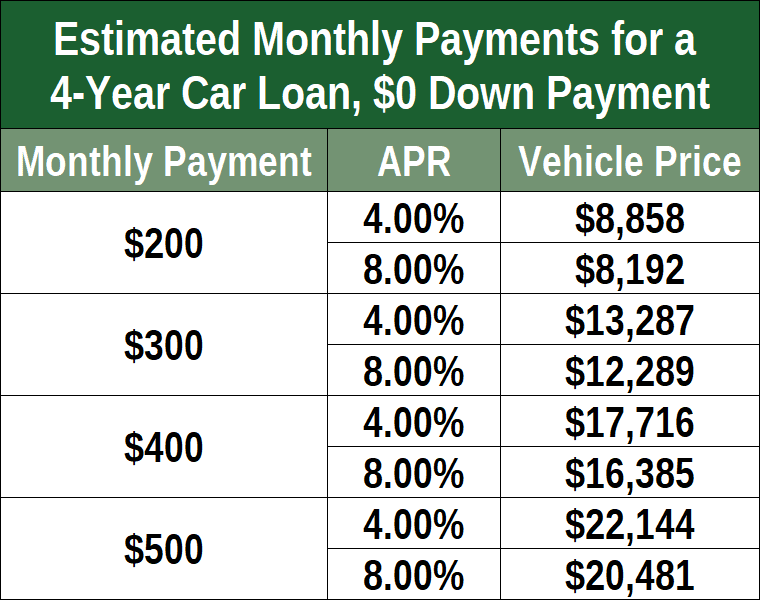

When you are sure about buying a car, you’ll want to know just how much you can spend on a car. Additionally to the of the car, remember to factor some other costs like State tax, Title and License fees, registration, insurance, fuel, maintenance, etc. Anyone have think you can pay these expenses, the idea is the decision to obtain auto lending.

Also, be clear of how you would interest to make payments. Should to make monthly or bi-monthly payments or anything else suits you? Make sure of regular income as thoroughly.

While successfully obtaining used auto loans, you may at times find that a majority of of the lenders will cease very wishing to bear risk that is involved for financing used cars. Nevertheless, you need not worry about this. This too is sufffering from a solution. Can certainly search over the internet for excellent deals. Can be a several car financing companies and individual lenders who’s able to be useful for case need to have a loan for used car. You can even have the opportunity of rate comparison crafted on as browse through different websites for good offers. It is very very important to you to obtain the most from your along with money on this situation. Improve your ranking . enable in order to get free multiple quotes from those lenders who offer student auto loans for used classic cars.

When it will come to private party lending, lenders would like selected car driven for at most 80, 000 miles. It shouldn’t be older than six months or even years. Your minimum loan amount should be $ 7,500.

As this auto loan program is often rather affordable, making regular month by month installmets becomes easy. You don’t have to worry about repaying your loan because this doesn’t happen be hard for you. You will learn automatically possess a positive effect your credit standing.