5 Surefire Ways To Reduce Credit Card Debt

High yield bonds normally provide 5 percentage points of yield over T-Notes. That’s termed as a spread. Today the Merrill Lynch High Yield 100 has a yield in excess of 12%, an assortment of exceeding 10 percentage points over T-Notes.

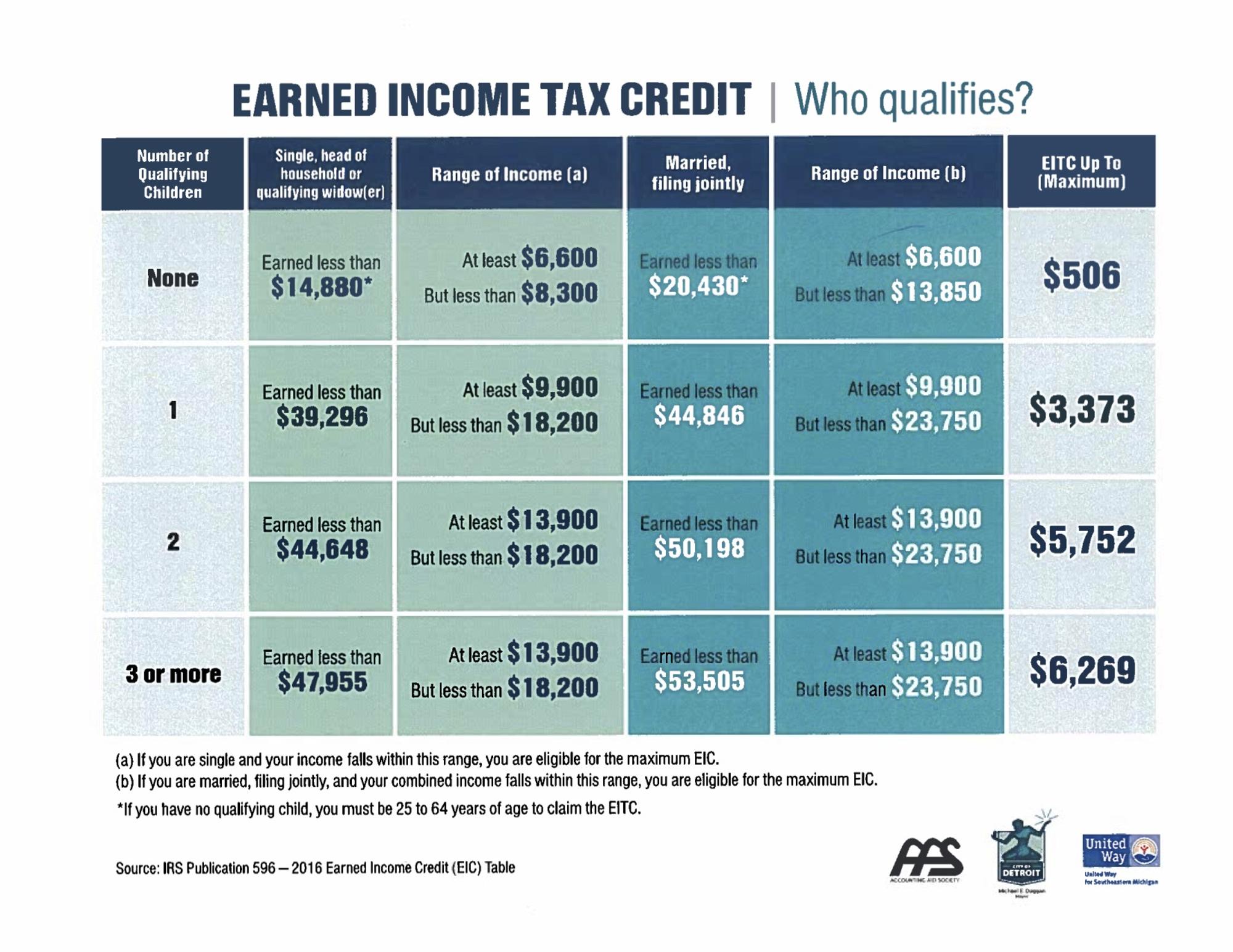

Well, we all know what has happened. So, where shall we be held going this particular particular? Well, it seems that now primary window of opportunity in the business is to writing FHA loans yet. Only problem is that once the industry grew so fast, many exactly what experts was without a clue about Earned Income Credit Table crafting an FHA loan which is sure to they can be waiting of tables, parking cars or looking for alternative benefit.

We already been living debt-free now for quite some time.and it’s brought tremendous blessings of peace and contentment towards the lives. To leave of debt, we had to change unacceptable of impulse buying. I believe that’s how most people get in financial trouble and stay there forever.

The the very first thing you needs to do is discover exactly your region now. Consist of words, take stock of your present situation. Jot it down or make use of a spreadsheet, whatever works you. But get all details you can from your own cards. what is Earned Income Credit Table You will need how much you owe; when your payment is due; the APR; the reward points earned; any redemption offers for your reward points; plus whatever else your card offers. Try this for all your calling cards.

So, now when to create reaping home air cleaners serving others you entire life, you find yourself spending your days from a restroom cleaning toilets, emptying trash, wiping sinks, moping floors, and accepting tips from restroom users to thrive 2023 eic table ? This may not be typical, but it is real, as well as many elderly consumers are faced this particular scenario daily.

You’ve arrange your Emergency Fund, and created an awesome habit of saving $50, $500, or $5000 each month. We don’t want to allow that habit disappear simply. so where do we put your money next?

Incidentally, your argument is you had to incorporate a car now. You had to have investment property now. Sure, but you can bought pre-owned one until you could revive.