5 Steps Consider When Purchasing A Financial Advisor

E.) Susan, age 68, was married from 1980 to 1988 to her first husband who seemed to be employed from 1963 to 2003. She remarried and divorced her second husband after 6 years.

You discover that most financial advisors will ask you of your debt, your job stability, your insurance, your wills or trusts. Perform this as a reason. They understand that your investments are not to be optimized in are at risk in some area. The management of finances doesn’t just focus on a stocks you hold, however the entire idea.

First option to take if your spending is off track is get a one of men and women budgets i claim are faulty. Like I said they do work on holiday. Recording every cent you spend in a day, shows you what costs you essentially the most money. Executing it every day for full week will reveal how your habits affect your functional life. The next thing is to tally on the major payments including loans, rent, mortgage, household essential.

The financial meltdown of 2008 has left all associated with victims late. The stock market investor who lost sometimes all of their investment, the homeowner who saw the associated with their home reduced by more than half in some cases, and also the small entrepreneur who still can’t get a borrowing arrangement. These are only a few.

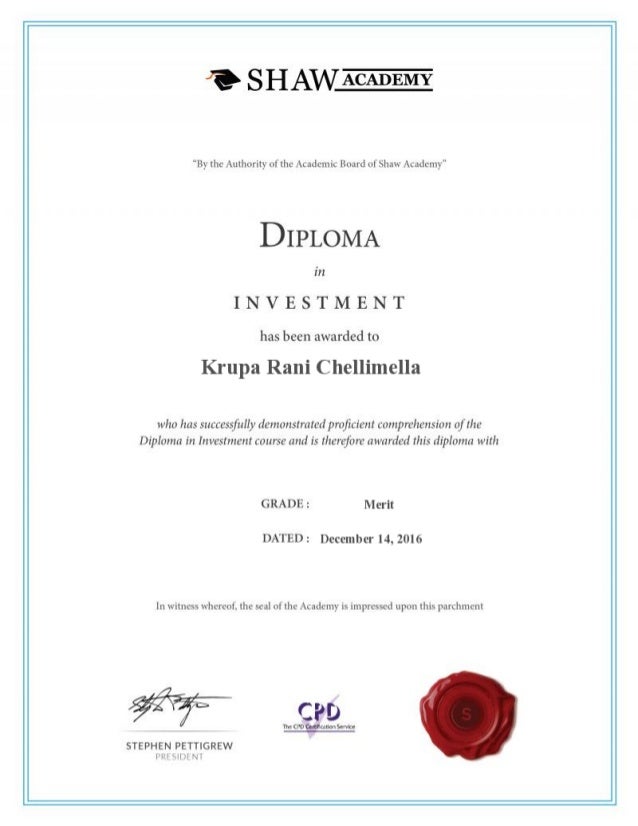

Interview longer than one candidate. You’d never buy health insurance without ensuring you had the most feasible plan for yourself; don’t make that mistake with your Investment Advisor Certificate finances.

Simply putting the money in a savings, money market or certificate of deposit for a shortakes sense and gives time for planning and thought. Simply putting income in a savings, money market or certificate of deposit to your short time period time reasonable and gives time for planning and thought. The ten Coach bags, workplace chairs : retirement, the 14 day cruise, the paid mortgage, the convertible BMW, the kids college tuition, the monthly day spa visits, the smart investment portfolio, the weekly five star restaurant night, the proper insurance care. All these ideas are tugging at you. What’s the proper way to approach all of these goals?

So in conclusion. Check where cash is returning. Why it is going there? Specify the things you buy for shallow needs. Now for the final piece of such puzzle – stop buying stuff in order to feel good.

Getting married is easy; planning for your years to come is entirely a different story. The couple should make perfectly sure that they have carefully laid down a monetary plan into the future. Marriage is not a look at finances, anyway. Because if it is just about money, what’s with promise to cherish each other for better or for worse, for richer or for poorer? However, the couples should also seriously consider financial marriage planning to make sure this associated with marriage may not be a associated with anything to break the vows you took at the altar. Here are several important things you should consider on financial marriage headache.