The Art of Financial Mastery: Unleashing the Power of Wealth Management

Are you ready to take control of your financial future? In today’s rapidly changing world, it has become more crucial than ever to have a solid plan in place for managing your wealth. This is where the art of wealth management comes into play. Personal financial planning and wealth management are essential skills that can empower you to make informed decisions about your money, ensuring both stability and growth.

At its core, wealth management is about optimizing your financial resources to achieve your goals and aspirations. It encompasses a range of strategies, including investing, tax planning, estate planning, and risk management. By carefully assessing your current financial situation and identifying your short and long-term objectives, wealth management enables you to create a roadmap for success.

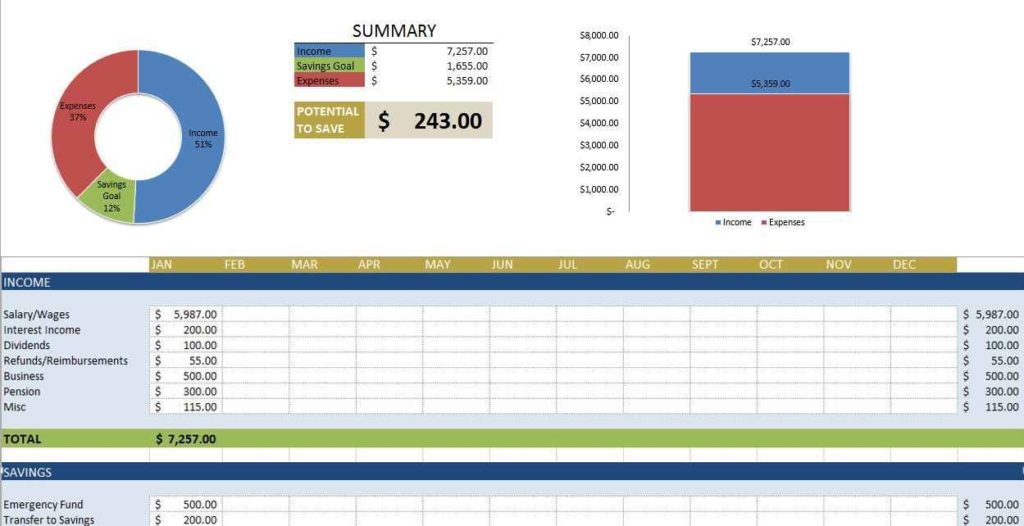

One key aspect of wealth management is personal financial planning. This involves assessing your income, expenses, assets, and liabilities to understand your financial standing. Through detailed budgeting and cash flow management, you gain a clear picture of your financial resources and how to allocate them effectively. Moreover, personal financial planning takes into account your risk tolerance, time horizon, and future financial needs, helping you shape your wealth management strategy accordingly.

In the quest for financial mastery, wealth management acts as a guiding principle. It empowers you to take charge of your financial destiny and navigate through the complexities of today’s financial landscape. By embracing the art of wealth management, you unlock the power to live a life of financial security, freedom, and abundance. So, let’s delve deeper into the art of financial mastery and discover how you can unleash the true potential of wealth management.

Setting Financial Goals

Setting clear and achievable financial goals is a crucial first step towards effective wealth management. By defining specific targets, you can develop a strategic roadmap for your personal financial planning. Whether you aspire to save for retirement, purchase a new home, or fund your children’s education, setting goals allows you to prioritize your financial decisions and allocate resources accordingly.

Begin by assessing your current financial situation and identifying areas where you would like to see improvement. Are you aiming to eliminate debt, increase your savings, or diversify your investment portfolio? Determine the timeframe in which you hope to achieve these goals, whether short-term or long-term, as this will help guide your financial planning process.

Once you have established your objectives, it is important to make them measurable. Assign specific financial figures or milestones to your goals, such as accumulating a certain amount of savings or paying off a specific amount of debt. This way, you can track your progress and make adjustments as necessary.

To help ensure success, it is beneficial to break down your goals into smaller, more manageable milestones. By taking incremental steps towards your larger objectives, you can stay motivated and maintain a sense of accomplishment along the way. Consider setting monthly or quarterly targets that contribute towards your ultimate financial goals, making them less overwhelming and more attainable.

Setting financial goals is not a one-time exercise. As your circumstances evolve, it is important to review and revise your goals periodically. Life events, economic changes, or shifting priorities may require adjustments to your financial plan. By regularly reassessing and adapting your goals, you can navigate the ever-changing landscape of wealth management with confidence.

Creating an Effective Wealth Management Plan

To achieve true financial mastery, it is essential to have an effective wealth management plan in place. With the right approach, you can navigate the complexities of personal financial planning and unlock the power of wealth management. Here are three key steps to help you create a plan that works for you.

-

Set Clear Goals: The first step in creating an effective wealth management plan is to define your financial goals. Take some time to ponder what you want to achieve financially—whether it’s saving for retirement, buying a home, starting a business, or funding your children’s education. By setting clear and specific goals, you can align your efforts and focus your resources in the right direction.

-

Assess Your Current Financial Situation: Once you have your goals in mind, it’s crucial to assess your current financial situation. This requires a thorough evaluation of your income, expenses, assets, and liabilities. Take stock of your financial health to understand where you stand today. This assessment will help you identify opportunities for improvement and determine the necessary steps to reach your goals.

-

Develop a Strategy: Armed with a clear understanding of your goals and financial situation, the next step is to develop a strategy that will guide your wealth management efforts. This strategy should consider factors such as risk tolerance, investment preferences, and time horizons. It should also involve diversifying your investments, minimizing expenses, and monitoring your progress regularly. By formulating a comprehensive strategy, you can increase your chances of long-term financial success.

Remember, an effective wealth management plan is not set in stone. It requires regular reviews and adjustments as your circumstances and goals evolve over time. By dedicating time and effort to create a solid plan, you can take control of your financial future and pave the way to financial mastery.

Strategies for Long-Term Financial Success

When it comes to achieving long-term financial success, personal financial planning and effective wealth management are crucial. Here are some strategies that can help you on your path to financial mastery:

-

Set Clear Goals: Begin by defining your financial goals. What do you want to achieve in the long run? Whether it’s saving for retirement, buying a home, funding your children’s education, or starting a business, having specific goals will provide you with direction and motivation.

-

Create a Budget: Developing a budget is an essential aspect of managing your wealth. Take the time to assess your income and expenses, and allocate your resources accordingly. This will help you track your spending, identify areas where you can save, and ensure that you are working towards your financial goals.

-

Diversify Your Investments: Investing wisely is a key component of wealth management. Instead of putting all your eggs in one basket, consider diversifying your investments across different asset classes. This can help spread out the risk and increase the potential for long-term growth.

Remember, achieving financial success is a journey that requires discipline, patience, and continuous learning. By implementing these strategies, you can take control of your finances and unleash the power of wealth management.